Where is Bitcoin Headed and What’s Driving the Latest Rally

-

Bookmakers Review

- November 27, 2024

There has been quite a surge in the price of Bitcoin in recent days. Here at Bookmakers Review, we investigate where the popular cryptocurrency coin is headed and what could be driving this latest rally.

The Recent History of Bitcoin

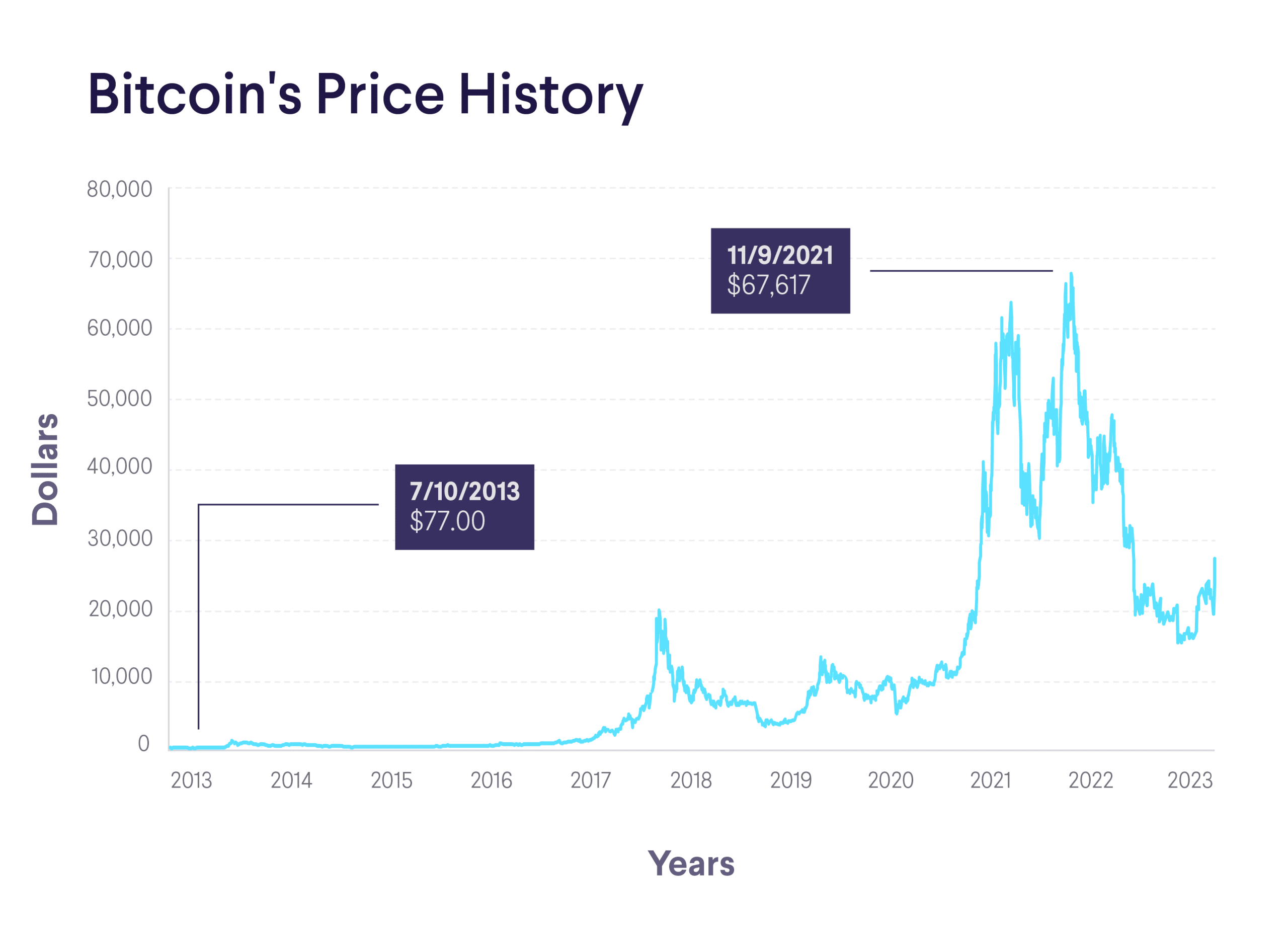

By now even the most non-interested parties in cryptocurrency will know a little about the metronomic rise in value during those heady years of Bitcoin that was followed by the crash two years ago. It’s a long way back to the halcyon days of the record price of $62,000 in October 2021. The fall saw the coin reach a low of $16,000 a month later with investors losing a huge 300% fall in asset value.

Since then, the currency has slowly but surely crept its way upward in value and reached $39,000 last week after a mini-surge from just above $30,000. That begs the question – Where is Bitcoin headed?

Where is Bitcoin Headed?

Firstly, let’s establish one thing, Bitcoin is here to stay. The effect the decentralized currency has had on the world economy pretty much guarantees its place in society for years to come.

We have seen Governments start to recognize and regulate the currency, while hedge funds have been dipping their toes in the water of the digital age for their investors.

EFTs (Exchange Traded Funds) are set to flood the cryptocurrency market in 2024 after financial giants Fidelity, Blackrock and Invesco saw the Libel victory for Grayscale vs. SEC, which opened the door for those financial institutions to confidentially bring their investors’ funds into the market in the New Year.

From that increased buoyancy in the markets for 2024, we can expect increased footfall and that will inevitably enhance confidence and trust in the sector for a bigger percentage of the population.

Those EFTs and buoyancy promised for the cryptocurrency will be a contributing factor behind the latest rally, but we also need to consider the Bitcoin halving process, which is scheduled for April. Historically, around the halving process that was written into the software algorithm of the coin, there has often been a surge in price both before and after the event.

What Has Driven the Latest Rally?

The latest rally for the coin in the later days of November appears to have been set off by Fed Chair Jerome Powell’s comments when discussing the economy. He insinuated that caution would be shown after he said,

“The pace at which the economy is creating new jobs remains strong and has been slowing toward a more sustainable level … Wage growth remains high but has been gradually moving toward levels that would be more consistent with 2% price inflation over time, and real wages are growing again as inflation declines.”

That inevitably means that Bitcoin, which is thought of as a risker option to stocks and shares, will become a more attractive option again for investors. If the Federal Exchange is determined to be cautious in the immediate future and follow Powell’s comments, then that will likely be a bullish driver for the price of Bitcoin. There is no doubt many shrewd investors in the digital currency took Powell’s comments as a green light to invest.

Those investors will be eyeing how the price will be sitting in April, the time of the halving, because, at $38,000 now, it is likely to be above $40,000 by then. In perspective, they will be pulling their old records from exactly two years ago in April 2022, when the price was above $43,000, just before the huge Boom and Bust that followed.

Bookmakers Review Conclusion

Here at Bookmakers Review, we investigated the subject of where Bitcoin is headed and voiced the reasons why we have seen a recent rally in price at the end of November.

We concluded that, with the EFTs flooding the market in 2024, and the halving due in April long-term, confidence in the cryptocurrency is on the rise. What we then identified was the recent rally, which was likely prompted by Fed Chair Jerome’s Powell comments about the economy, stating they would be cautious with interest rates. Those sorts of comments historically push many digital investors to feel confident which in turn, increases the value. Overall, the future of Bitcoin is bright and at Bookmakers Review, we believe it will be going in the right direction in 2024.